Until March 2018 I had very little idea about equity options. As I worked (and still work) in banking I at least possessed a fair idea about what an option is: it’s a financial instrument that gives the buyer of the option the right (i.e. the free choice, the “option”) to do something if certain things happen. This “certain things happen” aspect of options is where it gets tricky.

Options come in many different flavours but all of them confer a right to do something if certain conditions are met. This article is about the most common type of option, the equity option. An equity option is an option that is linked to an equity (also known as a share or a stock) and there are thousands of equities in the U.S. alone. Each equity represents tiny ownership of the thousands of mid-sized, large and gigantic companies.

The relation between an option and its linked, its “underlying” equity is strong. In fact, the relation is so strong that it allows the buyer of the option to buy or sell the underlying equity at an attractive price under certain conditions. Another aspect of an option is that it is cheaper, sometimes just a fraction of the price, of its underlying equity. This combination sounds very attractive: paying a bargain price and gaining the right to buy or sell an equity for a nice profit at some time in the future. However, there are of course strings attached to being able to exercise this right, hence the trickiness mentioned above.

1. The underlying equity must reach a certain price, called a strike price

2. This strike price must be attained before a specified date in the future, the expiry date

The probability that both of these two events (a given price by a given date) will happen can be estimated at somewhere between almost impossible to highly likely. This resulting probability is the biggest factor affecting the price of the option, relative to the price of its underlying equity. Put simply, the lower the probability, the lower the price, the higher the probability, the higher the price.

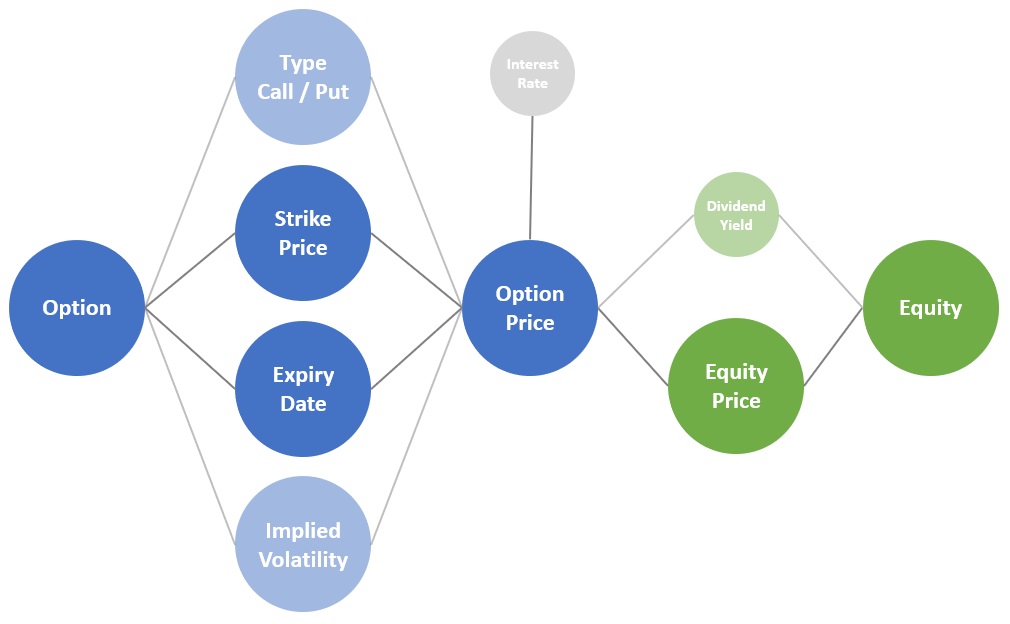

At this point it’s probably a good idea to supplement lengthy text with a visual representation of the factors that determine the option price. I’ve highlighted three of the option price factors (strike price, expiry date and equity price) in the diagram below but there are more than these three factors in reality. In order to avoid an overload of information in this introduction article I have greyed out some of the bubbles.

Diagram – Factors determining an option’s price

Strike price: the further away (depending on if it’s a call or a put option) this is from the current equity’s price, the less likely the equity will reach the strike price. So the further away, the lower the option price.

Expiry date: the further away this is in the future, the greater chance the equity will reach the strike price as there is more time to work with. So the further away, the higher the option price.

Equity price: the higher the equity’s price, the higher the option’s price. This is because if you want the right to buy something more valuable, you must pay a higher premium to obtain this right.

In the next article(s) I will describe the notion of implied volatility and the difference between the call and put option.